What Macro Risks Concern Mid-Sized Companies the Most in 2021?

By Tom Fitzgerald, President, Specialty & Commercial Insurance, QBE North America

Since the COVID-19 pandemic struck in early 2020, mid-sized company executives have had to manage through a unique period of rapidly changing business conditions. How are they feeling in 2021, what are the risks they worry about most, and do they have plans to mitigate those risks? Our 2021 Mid-Sized Company Risk Report offers answers based on an August 2021 survey and compares results to a similar survey conducted in 2020.

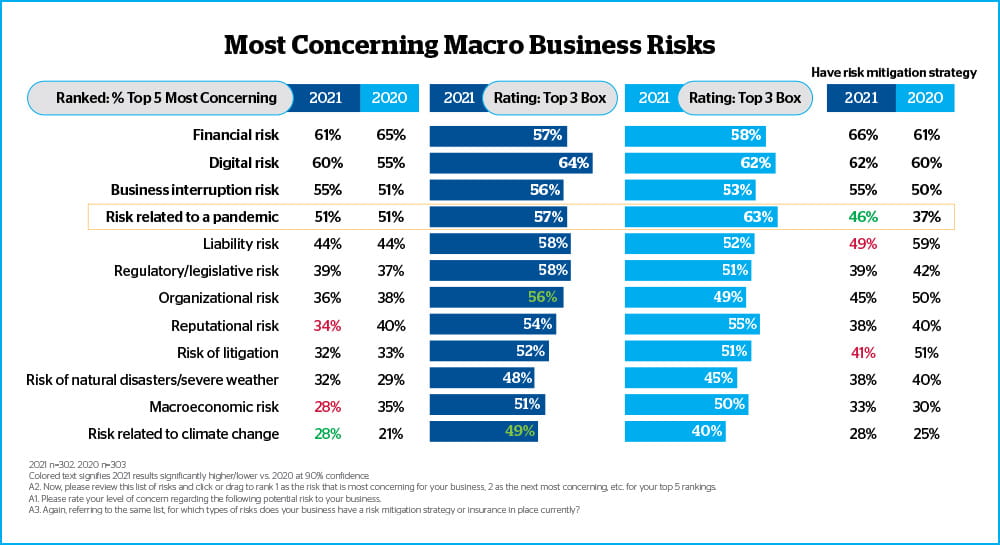

As the chart below illustrates, financial, digital, business interruption, and pandemic-related risks continue as top concerns from 2020 to 2021. Among macro risks of lesser concern, climate change risks increased significantly, while reputational and macroeconomic risks fell significantly.

When comparing companies’ level of concern about each macro risk with the percentage having a risk mitigation strategy in place, the middle to bottom third of the most concerning risks tended to have the greatest disparity. Climate change risk had the largest gap. Forty nine percent of companies reported a high level of concern about climate change related risks, while 28% said they had a risk mitigation strategy — a 21-percentage point gap. Other macro risks with large gaps included regulatory/legislation risk (19-point gap) and macroeconomic risks (18-point gap).

By contrast, for the top concern, financial risk, 57% reported a high level of concern while even more, 66%, had a risk mitigation strategy. For the next two most concerning macro risks, the gap between a high level of concern and having a risk mitigation strategy was negligible — only 1 or 2 points.

The contrast between levels of concern and having a risk mitigation strategy suggests that mid-sized companies may lack the resources to address all but their most concerning risks, and underscores the importance of engaging with their insurance brokers and carriers to enhance their ability to prepare for a wider range of risks.

For complete results, read the full report.