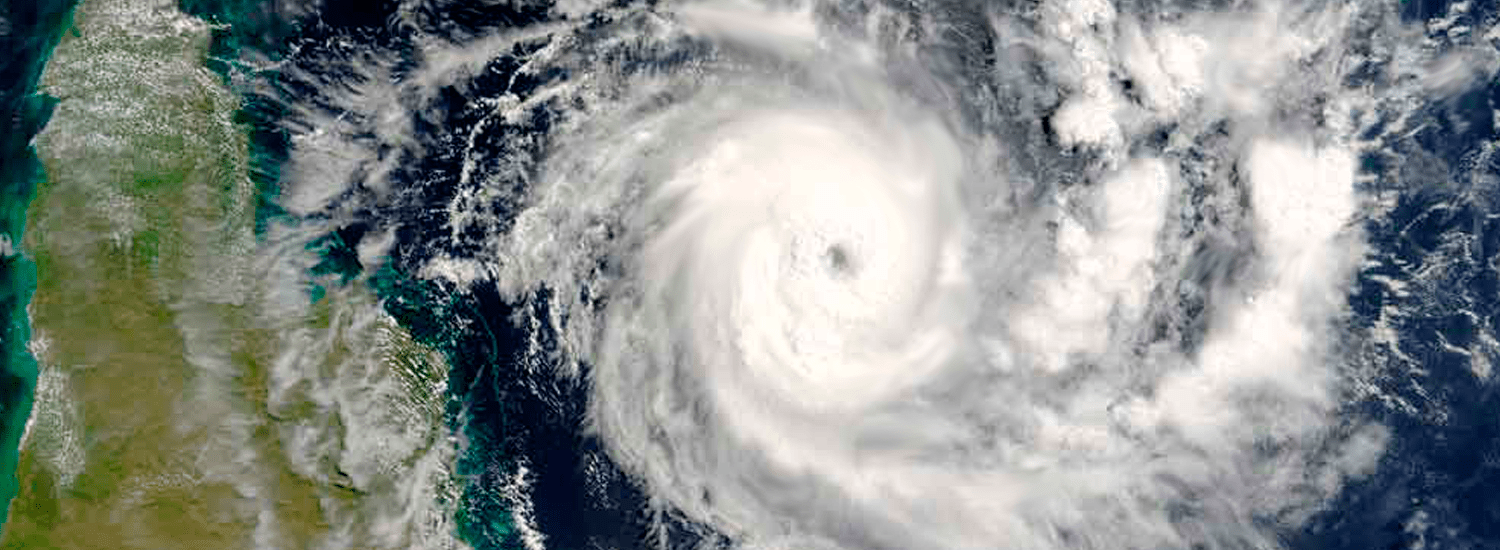

BOM weather outlook 2023-24: prepare for hot, dry conditions

- In September 2023, the Bureau of Meteorology (BOM) declared an El Niño weather event is underway

- That means we could see a hotter and drier spring/summer of 2023-24

- This comes with an increased chance of bushfire – so now’s a good time to prepare

What’s the BOM outlook for weather in Australia over spring and summer?

As we head into spring and summer of 2023-24, the Bureau of Meteorology has declared an El Niño weather event – which generally means less rainfall and drier conditions for much of Australia.1

The BOM reports the sea surface temperatures firmly exhibit an El Niño state, with climate modelling suggesting further warming is likely.2

What is an El Niño and how does it affect weather in Australia?

An El Niño is one of three states of the El Niño Southern Oscillation (ENSO) natural climate pattern.

During El Niño, the change in temperature patterns means water to the east becomes warmer, and the evaporation of cloud and rain follow – moving away from Australia.3

This increases the chances of higher temperatures, less rainfall, and drought4 – as well as an increased risk of bushfire. It presents real challenges for people across the country.

In August 2023, QBE surveyed 1,000 people and found that 84.2% of respondents were somewhat concerned, concerned, or very concerned about the increased likelihood of bushfires through a hotter and drier summer.5

Meanwhile, 73.9% were somewhat concerned, concerned, or very concerned about the dangers to their home if El Niño comes into effect.6

Reflecting on the devastating Black Summer bushfires

The Black Summer bushfires of 2019-20 are still fresh in the memories of many of us. The fires spread through more than 24 million hectares of land, claiming at least 33 lives directly, while almost 450 people subsequently lost their lives through smoke inhalation.7

More than 3,000 homes were destroyed.8

Black Summer came after the 2018-19 El Niño event,9 while 2019 was officially Australia’s hottest and driest on record.

Communities across New South Wales, South Australia, Victoria and Queensland were devastated by the fires, which resulted in $5.47 billion in insurance claims.10

At QBE, we received 5,129 claims and paid more than $285 million to our customers.11

Preparing for bushfire season: protecting your property

▢ Ensure gutters and chimneys are clear

Inspect your gutters, roof and chimney and clean out any debris, including leaves and sticks. This material is extremely flammable and can spark embers that encourage fire to spread more quickly.

▢ Inspect trees around your home – and keep all grass cut short

Cut back any tree branches within 10m and cut grass to under 10cm. By reducing the amount of flammable material around your home, you can reduce the chances of a bushfire taking hold.

▢ Look around your property and note the location of anything flammable

Sweep up any dry leaves from around the outside of your home and note the position of anything flammable. From gas canisters to wooden outdoor furniture, it’s vital you know where these items are so you can quickly move them if necessary.

Preparing for bushfire season: review your insurance

▢ Check you have the right amount of cover for your home

The amount your home is insured for should include things like the cost of materials and labour needed to rebuild your home, demolition and removal of debris, along with work required to prepare the land for a rebuild, constructing a similar building to applicable building codes and professional fees.

The amount your home is insured for is not the same amount as the sale value of your home and land.

Check your property’s Bushfire Attack Level (BAL) status to understand the standards a rebuild will need to meet, as this may have changed since the property was originally built.

▢ Make sure your contents are adequately covered

Check outbuildings, fences and gates are covered under your home insurance policy, as well as any recent large purchases, including home technology, sporting equipment, and sports bicycles or jewellery. Remember to keep your policy documents in easy reach or save them to the cloud.

▢ Make an inventory of your contents

It’s also good practice to keep a record of everything you own. Don’t forget items kept in cars, outbuildings or your workplace. Keep pictures and receipts in the cloud if possible for easy access.

Following these three tips can help ensure you’re covered if a bushfire hits. For the 2019-2020 bushfires, our records show 12% of people who made a claim were underinsured.12

Underinsurance is when your buildings or contents sum insured is not enough to cover the losses you incur in an insurable event, such as bushfire. This can happen due to increased costs of rebuilding your home, not adding new purchases to your policy, or simply guessing what’s needed.

An Insurance Council of Australia report into catastrophe resilience included an example of a family who lost their 1930s coastal property in New South Wales in the Black Summer fires. They hadn’t factored in the cost of rebuilding the property when taking out insurance, and ended up being $80,000 short.13

Preparing for bushfire season: make a plan

▢ Create a bushfire readiness plan and keep it handy

A bushfire readiness plan that details what to do in a bushfire is important. It covers when to move and where to go – so if a bushfire is on the way, you’re not trying to figure out things in a panic.

Your state’s fire service has downloadable bushfire action plans: New South Wales, Queensland, Victoria, South Australia, Western Australia, Northern Territory, Australian Capital Territory, Tasmania.

▢ Download your state’s fire alert app

Make sure you know of any fires in your local area – that way, you can watch and act. Download your state’s app and turn on notifications.

▢ If fires are nearby, have bags packed and ensure your car has fuel

If you need to vacate your premises, it’s likely you’ll be in a hurry, so it’s a good idea to have your essentials packed and easily accessible. Keep in mind the most important aspect is the preservation of life – both your household and your pets.

Being prepared can help protect yourself, your loved ones and your property.

Learn about QBE home and contents insurance and get a quote today.

1 http://www.bom.gov.au/climate/enso/

2 http://www.bom.gov.au/climate/enso/

3 http://www.bom.gov.au/climate/about/?bookmark=enso

4 http://www.bom.gov.au/climate/about/?bookmark=enso

5 QBE polling data, August 2023

6 QBE polling data, August 2023

7 https://www.abc.net.au/news/2022-08-26/black-summer-bushfires-caused-ozone-hole/101376644

8 https://www.redcross.org.au/media/releases/2020/world-disasters-report-2020/

9 https://www.climatecouncil.org.au/resources/what-the-return-of-el-nino-means

10 https://insurancecouncil.com.au/wp-content/uploads/2021/09/ICA008_CatastropheReport_6.5_FA1_online.pdf

11 QBE Insurance claims data 1 September 2019 – 21 February 2020.

12 QBE Insurance claims data 1 September 2019 – 21 February 2020.

13 https://insurancecouncil.com.au/wp-content/uploads/2021/09/ICA008_CatastropheReport_6.5_FA1_online.pdf