Why hospitality business owners choose QBE Small Business Insurance

Flexible cover

Our range of small business insurance options ensure you have the flexibility to choose the cover your business truly needs, without paying for extras you’re unlikely to use.

24/7 claims service

In tough situations, you’ll have access to expert claims teams and a selected supplier network ready to help – so you can keep operating with minimal disruption.

Australian-based call centre

With a focus on customer service, our team is here to help.

Why do hospitality businesses need insurance?

QBE's Small Business Insurance can be tailored to suit a range of hospitalities. Whether you run a café, restaurant, or takeaway, you face a number of risks on a day-to-day basis. The most common risks within the hospitality industry are:

- A customer or supplier becoming injured on your premises, such as slipping on a wet floor

- Food spoilage or stock deterioration caused by damage or breakdown of key equipment or machinery such as a refrigerator

- Loss of income due to a disaster or a catastrophe event damaging your property.

Our Small Business Insurance has been designed to cover these risks so that you can focus on serving your customers.

Business Liability

QBE’s Small Business Insurance automatically comes with Business Liability as your base. It provides cover for public liability including third-party personal injury and property damage. As a hospitality business owner you want to create a safe and welcoming environment for your customers, but unexpected accidents and incidents can happen. In the event that a customer suffers bodily harm or property damage while at your business premises you could be liable and face costly lawsuits.

Business Buildings and Contents

Maintaining a successful café or restaurant relies on a number of essential items to operate successfully: from the building to the contents such as coffee machines, chairs and tables, even knives and forks. If you own the building your café operates from, you will want to be able to quickly repair or rebuild should anything unexpected happen.

Our Business Buildings and Contents cover ensures your building and contents - such as furniture, stock, fixtures and fittings - are covered for accidental loss or damage as a result of insured events like fire and storm.

Your employee's tools, equipment, personal effects and clothing are also covered.

Equipment Breakdown

Due to your business’ need to prepare and serve fresh food and beverages, you probably rely on a number of items of expensive equipment such as refrigerators, ovens and other cooking equipment, as well as point of sale equipment.

Our Machinery/Equipment Breakdown covers the cost of repairing or replacing insured equipment if it breaks down. We will also cover the cost of hiring a temporary replacement item while the insured item is being repaired. An optional cover is available for an additional cost for deterioration of stock caused by the machinery breakdown.

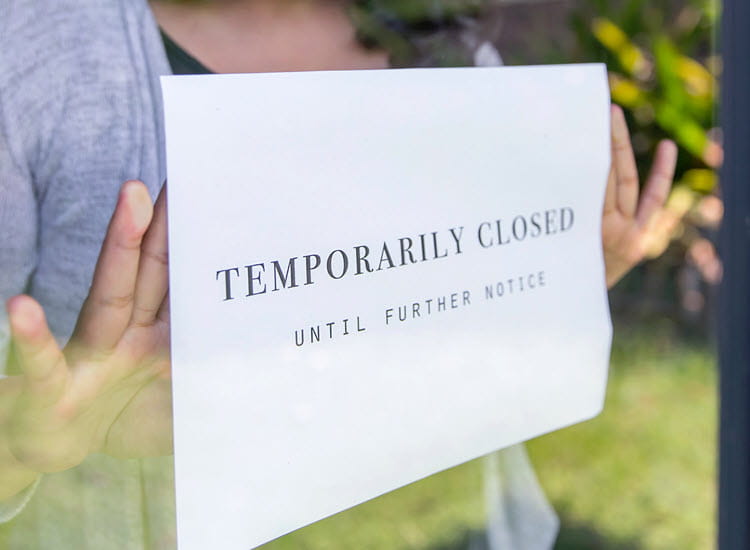

Business Interruption

Your café or restaurant may be forced to shutdown for months if a kitchen needs to be rebuilt and equipment replaced.

Could your business survive being shut for a few days, a week, or longer? Business interruption insurance covers loss of gross income as a result of loss of, or damage to, property caused by an insured event (such as fire).

Note: If you want cover for business interruption, you will also need to select Business Buildings and Contents cover.

You can also add

Whilst business liability, business building and contents, equipment breakdown and business interruption are the main insurance covers café and restaurant owners choose as part of their small business insurance, you can also add:

- Glass

- Theft

- Portable Items

- Money

- Tax Audit

Read the QBE Small Business Insurance Policy Wording to decide if the product is right for you.

Types of hospitality businesses we cover

- Café

- Take away food

- Restaurant

- Catering

- Mobile food van

- Bakery

Can’t see your business? Start a quote to see if you're covered by our online offering, or speak to your broker.

Frequently asked questions

Hospitality insurance is designed to cater to various businesses in the food and beverage industry. Eligible businesses fall into two main categories:

- Fixed location businesses: This category includes establishments like restaurants, cafes, take-away shops (e.g., fish and chips shops, sandwich shops), and even juice bars. These businesses are generally eligible for hospitality insurance.

- Mobile businesses: If your business operates on the move, such as caterers, food trucks, coffee vans, and ice cream vans, you may also be eligible for hospitality insurance.

Whether your business has a fixed location or operates on the go, there are insurance options available to meet the unique needs of the hospitality industry.

What customers say about QBE Small Business Insurance

Take your business further with these helpful articles

Tap and go: Portable customer payment options for small businesses

Accepting customer payments in more places makes good business sense. So, what is the best mobile payment app for small business? Here’s an overview.

Read articleHospitality insurance: Your simple checklist

When you run a café or restaurant, you face risks every day. But do you have the right cover?

Read articleHow to use social media for business: 7 tips for success

Social media can be a powerful marketing tool for small businesses. From what to post, to which platform to choose, here are seven tips to get you started.

Read moreThis advice is general in nature and has been prepared without taking into account your objectives, financial situation or needs and may not be right for you. You must decide whether or not it is appropriate, in light of your own circumstances, to act on this advice. To decide if this product is right for you, please read the QBE Small Business Insurance Policy Wording (QM9264). Insurance issued and underwritten by QBE Insurance (Australia) Limited (ABN 78 003 191 035, AFSL 239545).