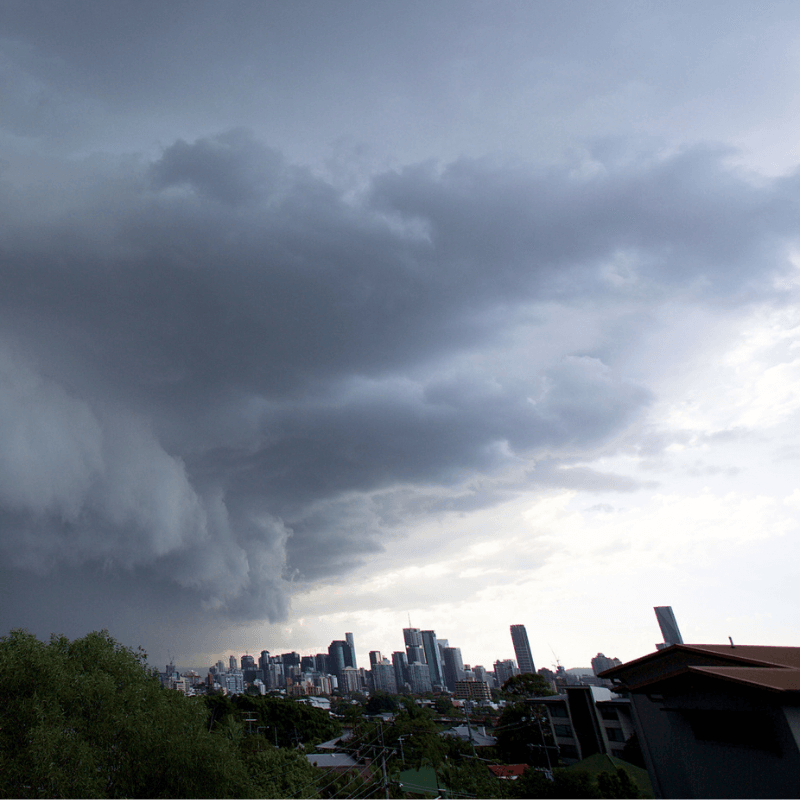

Before the storm: Preparing your business for storm season

- Get your business premises ready now and move excess stock inside or protect it

- Make sure your employees know how to protect themselves should a storm hit

- Talk to your broker to ensure you have the correct insurance.

Australia’s a country of increasingly extreme weather events, and storms can hit at a moment’s notice. For businesses across the country a severe storm can mean significant damage to your property, stock and possessions – not to mention disrupting day-to-day operations.

With some careful planning and preparation, however, some of the risks businesses face can be minimised, and some of the impacts mitigated.

Building maintenance

If your business has a physical location, it should be maintained in much the same way that residential premises are. Clear gutters are critical for managing high volumes of rainfall, roof tiles should be checked and replaced if damaged, and trees in close proximity should be trimmed back if possible. If your premises are rented, speak with the building owner to ensure these areas are addressed.

“Of course, some businesses will have stock stored outdoors, and in these cases are likely to have a range of structures such as greenhouses, polytunnels and shade cloths, to name a few” says Dave Burnage, Underwriting Manager, SME at QBE.

“When it comes to these more fragile structures, businesses should check their policy to ensure that they have adequate cover. They should also complete maintenance checks regularly and ensure they’re as well maintained as they can be, and high value stock should be moved indoors whenever possible during storm season.”

Looking after stock

Stock is the lifeblood of many businesses, and often, for example in the case of garden nurseries and car retailers, that stock is often stored outdoors.

“Hailstorms can cause significant damage and can often change direction without warning taking businesses by surprise. Being able to quickly get stock under cover is key in the event of a storm – whether that means moving it indoors or under suitable hail protection,” says Burnage.

In addition, when storms strike without warning, they can also bring with them large volumes of water in a short period of time.

Ensuring any stock held in basements is always off the ground, on pallets or racking can often help protect it in these scenarios - lifting goods a few inches off the ground could make all the difference if you get water ingress. Sandbags, too, can be invaluable in preventing water from entering your premises in the first place.

Businesses on the road

It’s not just car retailers that have business vehicles. From delivery firms to mobile service providers, taxi companies to farmers, many businesses rely on transportation each and every day.

“It goes without saying to get your vehicles and machinery undercover if possible,” says Norm Casamento, Head of Motor Claims at QBE.

The most important thing is the safety of the people in the vehicle and it’s incumbent on the business owner to ensure staff know the expectations upon them if they’re out driving.

“If a storm hits, pull over somewhere safe and find shelter,” says Casamento.

“The safety of people in the vehicle has to be the priority.”

For businesses, that means ensuring the protocol for driving in storms is known, understood and adhered to – regardless of any external pressures.

Another key consideration is the amount of insurance cover businesses hold for vehicle damage.

“On a farm, there may be a number of vehicles and pieces of machinery, but only $10,000 of first-loss cover, because people reason that if a vehicle or piece of equipment breaks, or is stolen, it’ll only be one thing affected.

“A hailstorm isn’t that kind.”

The importance of business continuity

Of course, you’re never going to eradicate the threat of a storm. And if your business premises suffer serious damage or flooding, or your location is cut off, it’s going to cause problems.

That’s where a business continuity plan comes into its own.

“Every business should have a business continuity plan detailing what you’ll do in different scenarios,” says Burnage.

“What will you do if your suppliers’ route is blocked? What will you do if your building is damaged?

“Spending a few hours exploring different eventualities and working out how you’d respond is time well spent, and far better than having to think on your feet in the middle of a disaster.”

As part of your business continuity plan, you should identify a Cloud back-up system for all of your business information, if you don’t already have that in place.

In addition, a back-up generator to supply emergency power is important, as is talking with your neighbouring businesses.

“Many businesses, particularly in more regional areas, have a reciprocal help plan in place,” says Burnage. “Speak with other business owners to see how you could help each other should you need it.”

As well as having a business continuity plan, business interruption cover is also incredibly valuable, as this can cover income and expenses while the business gets back on its feet.

Ensure you’re insured

Now’s a good time to speak with your broker to check that your insurance policies are valid and have everything insured that needs insuring – from buildings to stock, your business to your vehicles. If you haven’t reviewed the insured values in a few years, it’s wise to do so. Costs of building repairs and goods may have increased significantly.

Remember, if you are affected by a storm, the quicker a claim is lodged, the quicker your insurance provider can react and help you to return to the position you were in before the incident occurred.